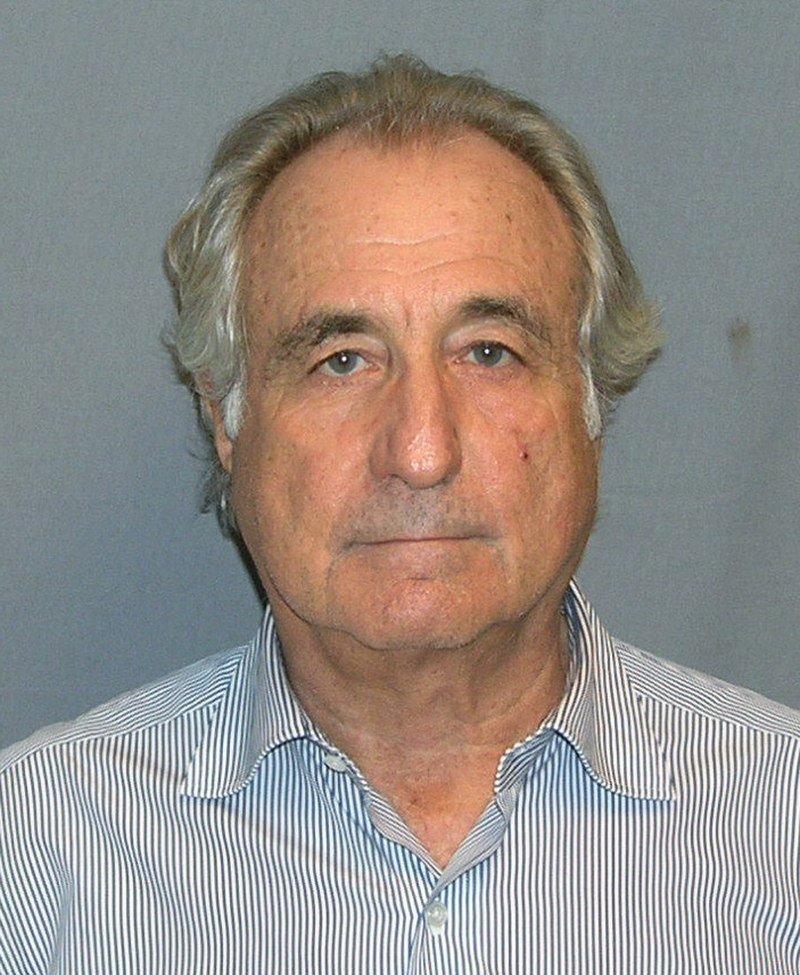

Bernard Madoff’s Arrest (2008): The Unraveling of a Massive Ponzi Scheme

In the annals of financial fraud, few cases have been as shocking and far-reaching as the arrest of Bernard Madoff on December 11, 2008. This event marked the beginning of the end for one of the largest and most devastating Ponzi schemes in history.

Bernard Madoff, a former chairman of the NASDAQ stock exchange, was once a highly respected figure in the financial world. However, behind the façade of success and prestige, Madoff was secretly operating a fraudulent investment scheme that would eventually defraud thousands of investors of billions of dollars.

Much like other Ponzi schemes, Madoff’s operation relied on a constant influx of new investor funds to sustain the illusion of profitability. Investors were promised consistent and high returns on their investments, which was made possible by using money from new investors to pay off earlier investors. This pyramid-like structure would eventually collapse when new investments slowed down or dried up.

The unraveling of Madoff’s scheme began when his sons, Mark and Andrew, confronted him about their suspicions. They were unable to reconcile the returns their father was claiming with the actual market conditions. Realizing that something was amiss, they reported their father to the authorities.

The arrest of Bernard Madoff sent shockwaves throughout the financial world and beyond. The scale of the fraud was staggering, with estimates suggesting that Madoff had defrauded investors of approximately $65 billion over several decades. The victims included individuals, charities, and even celebrities.

As the investigation unfolded, it became clear that Madoff had been able to deceive investors and regulators for so long by maintaining an air of respectability and trust. He used his position as a former chairman of NASDAQ to lend credibility to his operation. Additionally, Madoff’s reputation as a philanthropist and his involvement in various charitable causes further enhanced his image.

The fallout from Madoff’s arrest was not limited to the financial losses suffered by investors. It exposed significant weaknesses in the regulatory framework that allowed such a massive fraud to go undetected for so long. The Securities and Exchange Commission (SEC), the primary regulatory body overseeing the securities industry, was heavily criticized for its failure to uncover Madoff’s scheme despite receiving numerous red flags and tips over the years.

The Madoff case prompted a reevaluation of securities regulations and investor protection measures. The SEC implemented reforms to improve its ability to detect and prevent fraud, including the creation of specialized units focused on investigating complex financial crimes. Additionally, new legislation was introduced to enhance transparency and oversight in the financial industry.

The aftermath of Madoff’s arrest also saw a wave of lawsuits and legal actions against those who were complicit in the scheme or had failed in their fiduciary duties to protect investors. Several financial institutions, including prominent banks, were implicated in facilitating Madoff’s fraud by either knowingly or unknowingly enabling his operations. These institutions faced significant reputational damage and hefty fines.

Furthermore, the Madoff case highlighted the importance of due diligence and skepticism in the investment world. Investors became more cautious and aware of the potential risks of fraudulent schemes, leading to increased scrutiny and demand for transparency from financial institutions and advisors.

Today, the name “Madoff” has become synonymous with financial fraud and deception. The arrest of Bernard Madoff in 2008 exposed the dark underbelly of the financial industry and served as a wake-up call for regulators, investors, and the general public. It serves as a reminder that even the most reputable figures can be capable of committing egregious acts of fraud, and vigilance is necessary to protect against such schemes.

Sources:

- SEC Press Release on Madoff Case

- FBI – Madoff Pleads Guilty to Largest Ponzi Scheme in History

- The New York Times – Bernard L. Madoff

Excerpt:

Bernard Madoff’s arrest on December 11, 2008, marked the beginning of the end for one of the largest and most devastating Ponzi schemes in history. Madoff’s fraudulent investment scheme defrauded thousands of investors of billions of dollars over several decades. This event exposed significant weaknesses in securities regulations and led to reforms aimed at enhancing transparency and investor protection. The fallout from Madoff’s arrest also resulted in legal actions against complicit individuals and institutions, highlighting the importance of due diligence and skepticism in the investment world.